Name: Contrarian Value Fund

ASX Code: CVF

Dividend yield: 6.55%

Market Cap: $79.77mil

Price: 1.19 (20/06/2018)

Pre – Tax NTA (31st May): 1.30

Premium/Discount: 9% discount

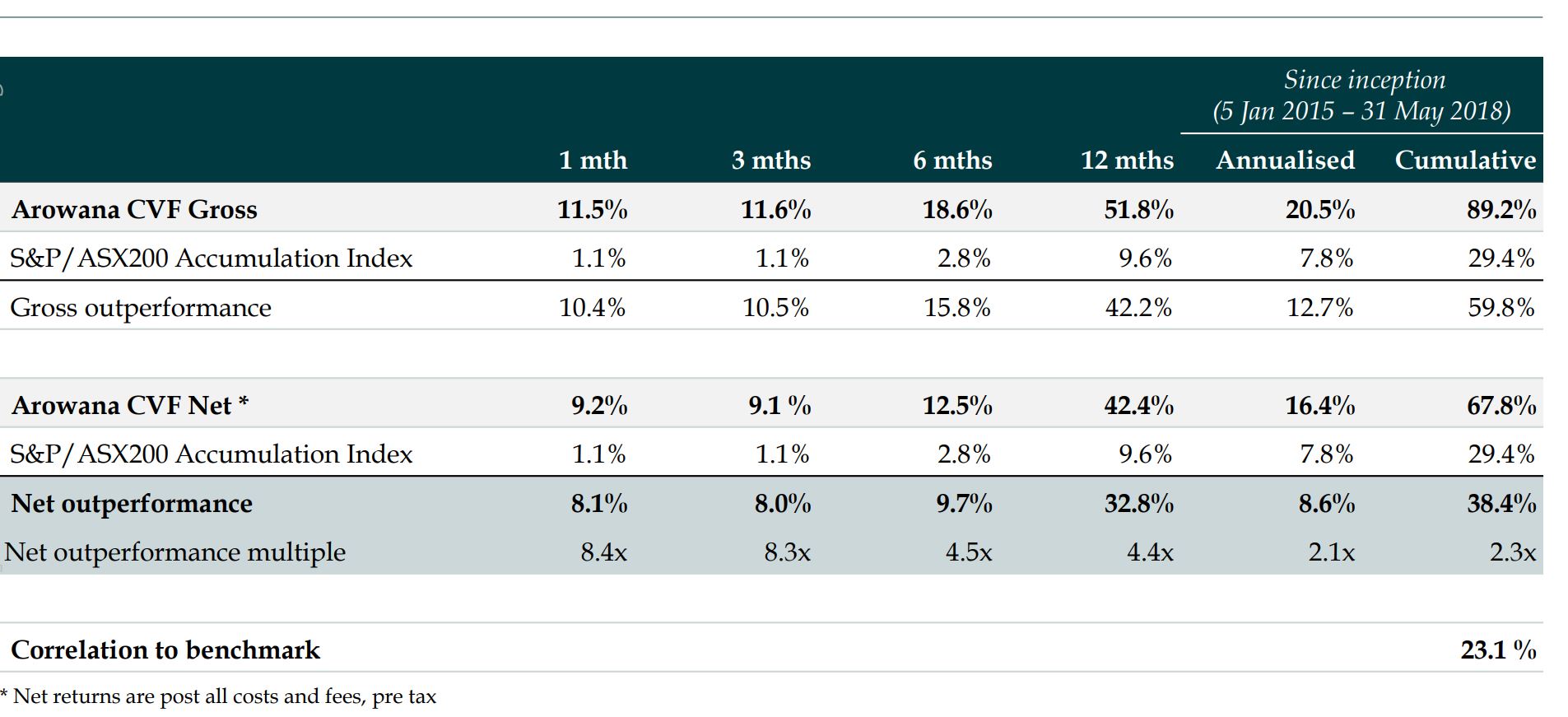

Contrarian Value Fund (CVF) is a conventionally structured Listed Investment Company (LIC) that listed on the 5th January 2015. It is run by Arrowena (ASX:AWN), a multi faceted venture capital company that has a range of financial interests globally. CVF has three team members, Gary Hui (Portfolio Manager and lead analyst), Ben Wolrige (Senior Analyst, CFA, CA) and John Graham (Data Scientist, PhD Mathematics). Since listing, the underlying CVF portfolio has outperformed the ASX200 Accumulation index by a cumulative 38.2% after fees.

How does the Contrarian Value fund invest?

The fund primarily invests in Australian stocks, however has a mandate that allows it to invest up to 45% of its assets overseas, which it has currently reached. The fund also has the ability to hedge currency and use derivatives for short selling and/or leverage.

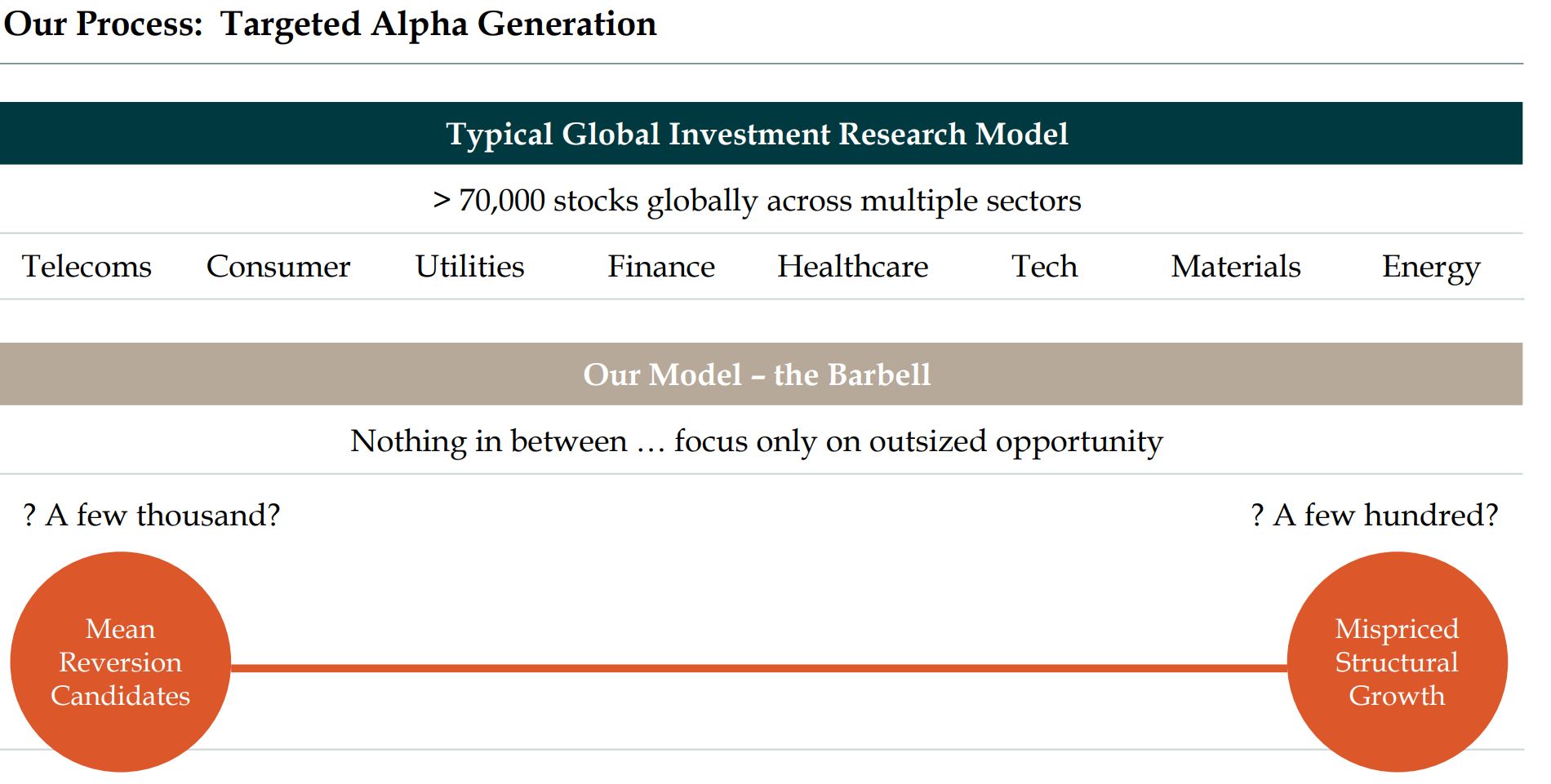

In terms of finding specific stocks; the managers believe that “the greatest investment opportunity occurs when there is significant change or new information that is misunderstood” and focuses its attention primarily on stocks that are “mean reversion candidates”or “mispriced structural growth” opportunities.

The team believes that by focusing on their barbell strategy (FYI: the orange image above is meant to look like a barbell) that it will deliver asymmetrical out performance relative to risk taken.

The CVF team use data extensively claiming that “the value of data is inversely proportional to its availability and directly proportional to its relevance”. The ability to successfully interpret key company drivers from large amounts of data is a key comparative advantage for the team.

Portfolio Performance and Price

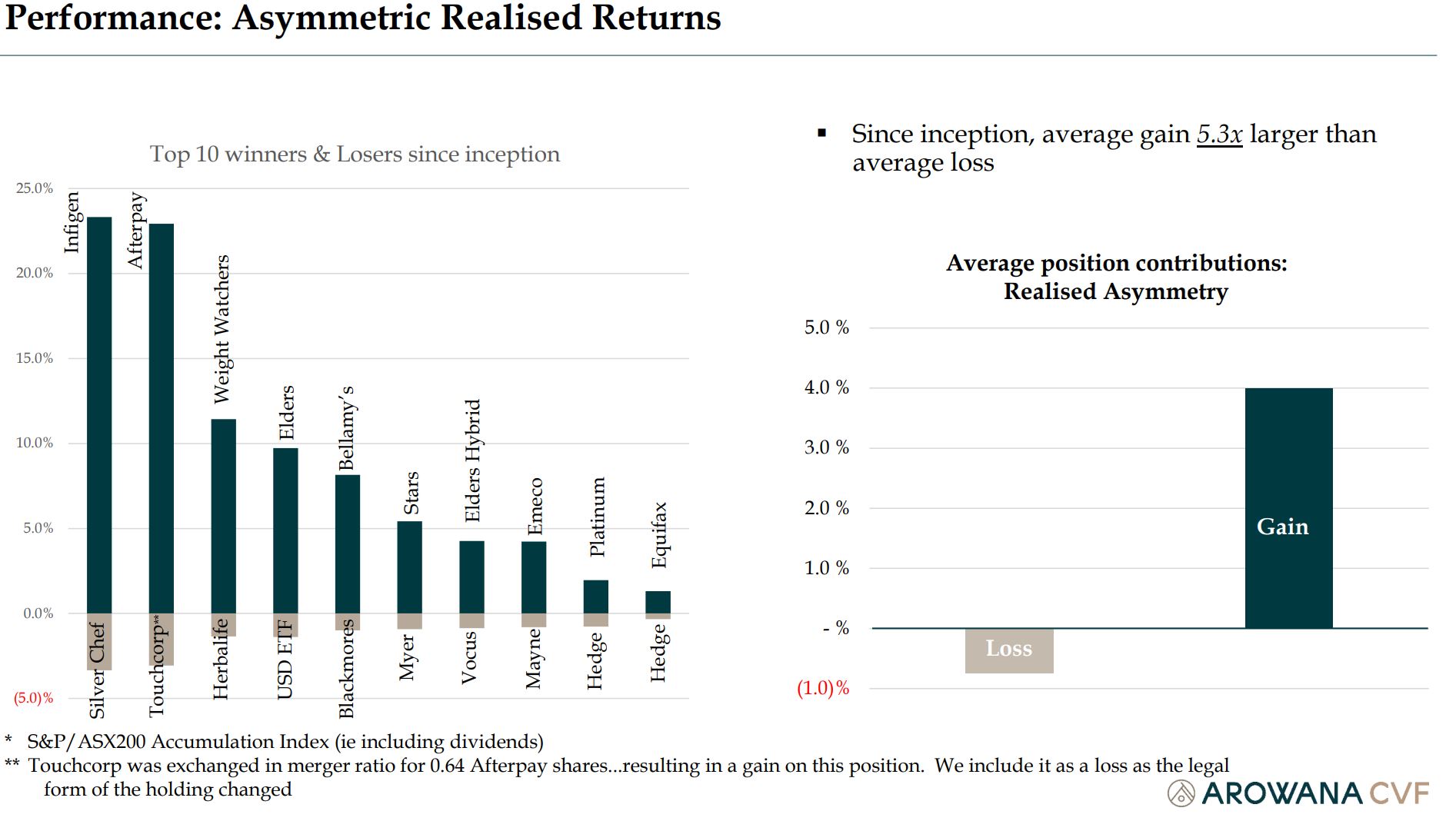

The recent performance of the underlying portfolio has been very strong as the below table outlines.

The current portfolio is extremely concentrated with 48% of total assets invested in the top five largest holdings and 15% invested in the largest holding, Afterpay Touch Group Limited.

The fees charged include a 1% of portfolio management fee and a performance fee equal to 20% of any out-performance over the hurdle which is 8% per annum IF the ASX200 Accumulation index is positive for the same period. IF the ASX200 Accumulation is negative the hurdle is 0%. Performance fees are subject to a high watermark.

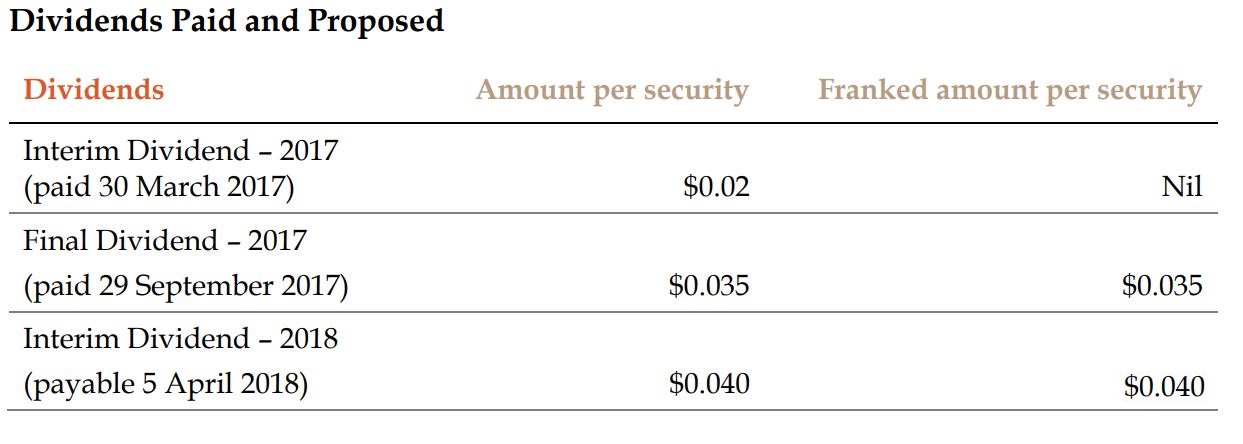

The company has a good history of dividends given its relatively short history.

On 27th February 2018 it announced it had approved the establishment of a Dividend Distributions Reserve and transferred $6,000,000 to that reserve. Further to this, tax paid for period to 31st December was $4,376,535, giving them a large pool of franking credits to draw on. These factors combined indicate that the company will have strong capacity to pay fully franked dividends moving forward. The company has also announced an ongoing buyback at the directors discretion, to keep the share-price from drifting too far from Net Tangible Asset backing.

ASX Dividend Aristocrats Analysis

The CVF is an interesting fund with a unique investment approach that seems to be working very well so far. The ability of the team to successfully identify “deep value” contrarian value opportunities as their name suggests such as Elders and Emeco indicates that they can “walk the walk” when it comes to investing in unloved and out of favour stocks. Their stated “barbell” strategy also gives us confidence that they will be able to sift through the huge pool of overseas shares when seeking to invest offshore. The inclusion of a 30 year data scientist veteran with a PhD in Mathematics definitely gives the team a point of difference when looking at investment opportunities.

The fee structure is standard for active LICs (WAM Capital use the fee structure) and is at the higher end, however essentially they don’t get paid bonuses unless they out-perform, so investors and management are aligned.

CVF currently trades at an approximately 10-15% discount to NTA and the CVF board has shown through the creation of a dividend reserve and share buyback that they are trying to become an elite LIC that trades at a premium to NTA and pays a consistent and growing stream of dividends. As they are relatively new and on the small side ($80mil market cap) they have limited recognition in the professional planner community, however with the initiation of consistent dividends and regular marketing of the fund this may change, which could lead to a compression of the discount and enhance any portfolio returns investors may receive.

CVF would be a worthy consideration in an investors portfolio at current discount to NTA. Allocating a small portion of total capital would be wise, as any fund with 10-15% positions can have severe under-performance if they get their calls wrong. The potential for out sized returns however would make any associated volatility well worth the ride.

Opinions are the authors own and all images are sourced from CVF public presentations. All information is general in nature and not intended as personal financial advice.

Leave a comment