Name: Djerriwarrh Investments Limited

ASX Code: DJW

Founded: 1989

Dividend yield: 4.70%

Market Cap: $847 Million

MER:0.45%

Price: $3.23

Pre – Tax NTA (22 October): 3.41

Premium/Discount: -10%

Djerriwarrh is a listed investment company that was founded in 1989 and listed on the ASX in 1995. They invest in Australian equities with a focus on stocks where there is an active options market. Djerriwarrh aims to provide shareholders with attractive investment returns through access to a steady stream of fully franked dividends and enhancement of capital invested. The Company uses exchange traded options to enhance income return to investors and typically pays out a high percentage of profits as fully franked dividends.

How does Djerriwarrh Invest?

Djerriwarrh’s investment philosophy is built on taking a medium to longer term view of value which means they tend to buy and hold individual stocks for the long term based on a selection criteria which, in summary, comprises a focus on:

- assessment of the target companies management, business strategy, barriers to entry and growth potential.

- key financial indicators, including prospective price earnings relative to projected growth, sustainability of earnings and dividend yield (including franking) and balance sheet position including gearing, interest cover and cash flow.

Djerriwarrh concentrate on stocks where there is an active options market. This is intended to give scope for the writing of exchange traded options with the level of the portfolio ‘covered’ by call options typically ranging between 20 to 50 per cent of the total portfolio at any one time.

As Djerriwarrh is looking to write options over their portfolio, the majority of their holdings are in large ASX 50 – 75 stocks, who typically have an active options market.

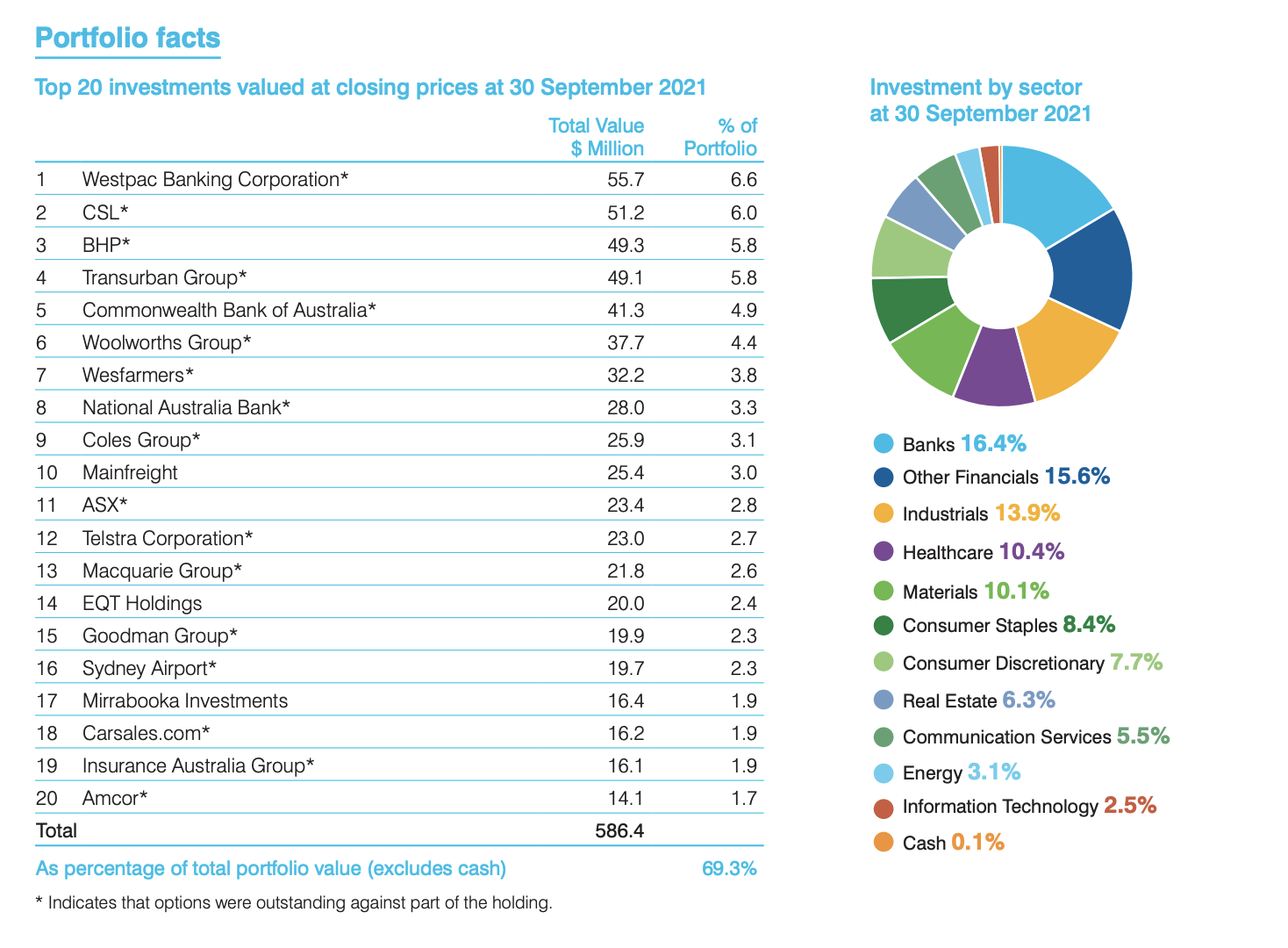

The sector breakdown and top 20 holdings of the portfolio is below;

Compared to the ASX200 sector breakdown, Djerriwarrh is relatively overweight financials and underweight the Materials sector (mining) however there is not a large differentiation to the ASX200 index.

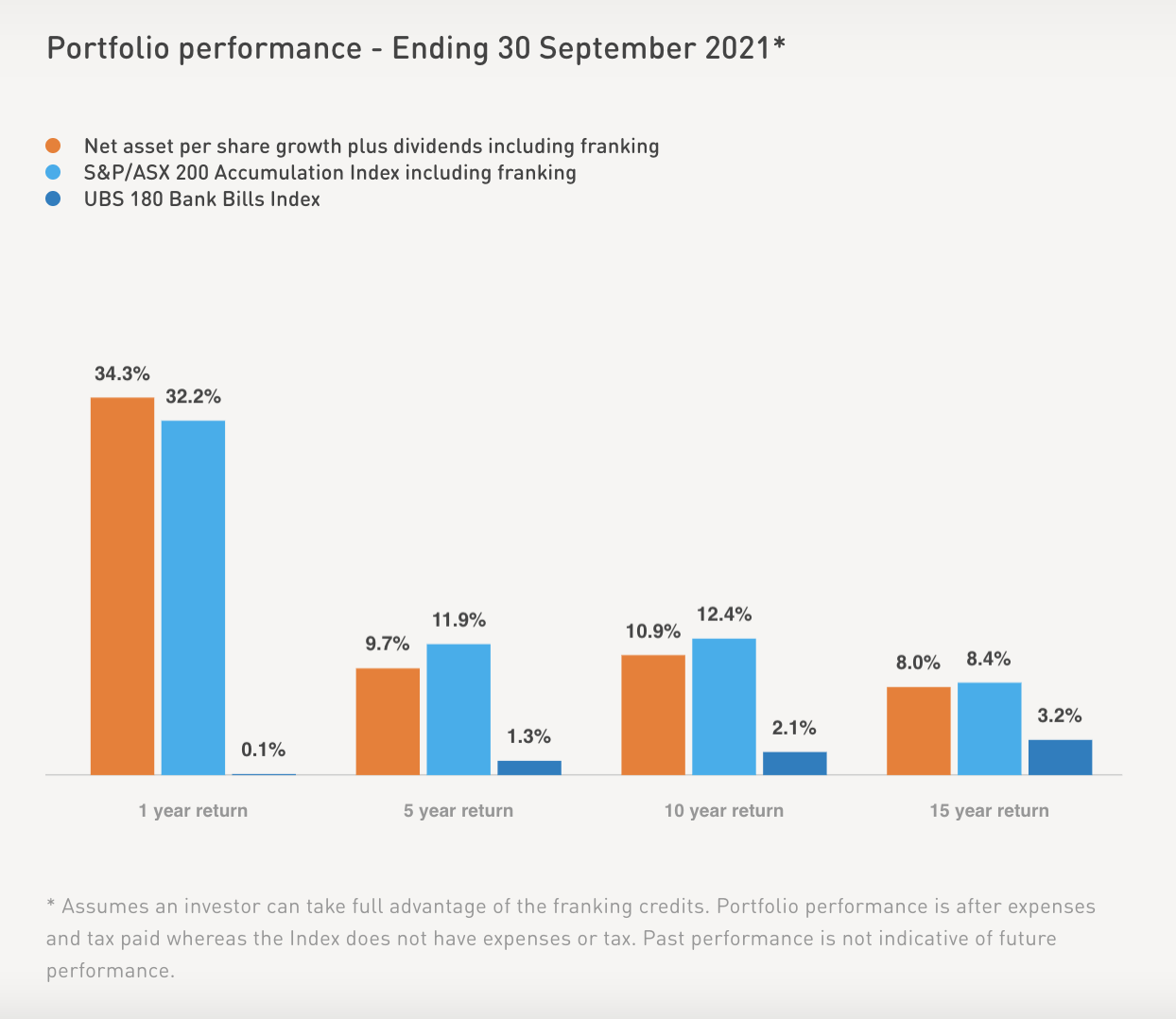

The long term performance of the underlying Djerriwarrh portfolio is immediately below. It is largely inline with the ASX200.

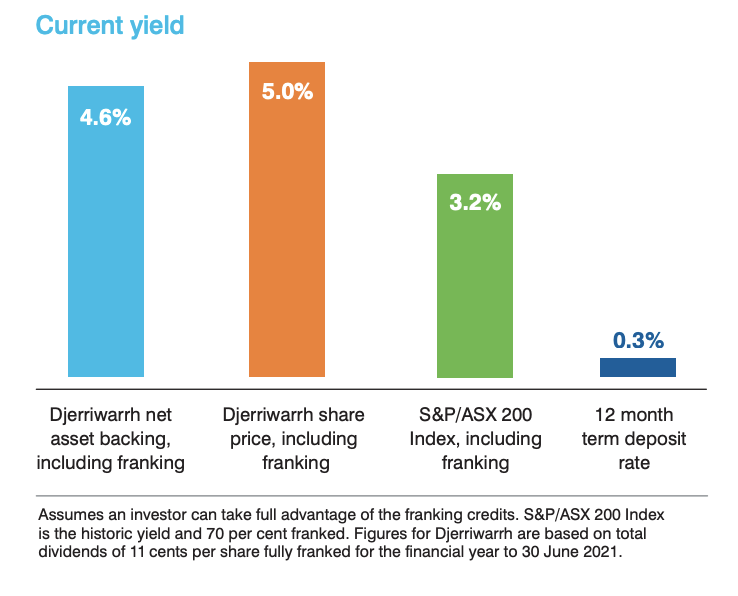

The yield difference between Djerriwarrh and the ASX200 is immediately below, which a key point of difference between Djerriwarrh and most other LICs.

It is worth noting that Djerriwarrh has traditionally traded at a severe premium to NTA, this has recently evened out and actually gone negative as the wider market has grown strongly.

ASX dividend Aristocrats Conclusion

Djerriwarrh is 29 year old listed investment company that has low costs (0.44% of assets under management) and a good track record of delivering solid long term performance that largely matches the All Ordinaries index. The key difference with Djerriwarrh is the make up of their returns vary greatly from most LICs, with a higher percentage of their returns coming as income. This is due to their focus on using the options market to generate income from covered calls over their portfolio. Consequently, Djerriwarrh is very attractive to investors who prefer income over capital appreciation. A major benefit of Djerriwarrh is that their income is fully franked which has extra appeal to superannaution investors (especially those in pension phase). As with most large LICs, their asset base prevents them from trading too frequently or investing in smaller stocks as their flow of capital would move prices against themselves. Currently Djerriwarrh is trading at a -10% discount NTA.

Given the strong wider share market performance and the hype around growth investing (tech, IPOs, bitcoin, etc) investors have been migrating away from DJW for higher growth investments and its once strong premium has evaporated. The performance is also middling and although they have a focus on income, over the medium to long term this has not born out into meaningful outperformance. In the last few years their dividend has also reduced as their income from writing calls has dissipated.

For an income focused investor looking to buy an LIC at a discount to NTA, Djerriwarrh would make sense, doubly so if you believe their strong premium will return. However outside of that focus, we feel there may be better choices in the market. Looking to others.

This information is general in nature and not intended to be personal financial advice.

Leave a comment