Name: Bennelong Concentrated Australian Share Fund

Founded: 2009

Fund size: $702 Million

Bennelong Concentrated Australian Share fund is managed by Bennelong Australian Equity Partners, which is a professional fund manager that offers five different strategies. In total BAEP manage $3 Billion for clients, this fund has $702 million in it. The fund and company is spear headed by Mark East who has over 25 years experience in managing clients money, there are four other analysts on the team who support him.

How do Bennelong invest?

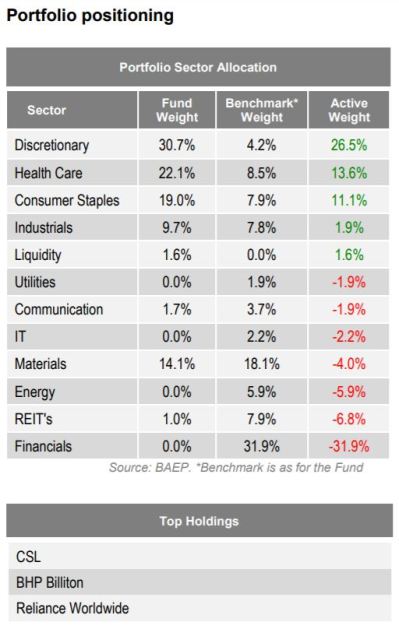

The portfolio for this fund consists of the teams best ideas and often only has 25-30 stocks in it (as opposed to 100+ for some competitors). The team take an index unaware approach, meaning they don’t invest in stocks just because they are a large part of the overall market. For example, the fund currently has little exposure to the big four banks as they feel their future is un-favorable.

The Bennelong team prefer to focus on companies with high growth prospects. BAEP believes that these types of companies offer the best long-term returns, in particular through the growth in shareholder value over time, and with lower risk.

Within the context of these types of companies, BAEP targets those with underestimated earnings strength. BAEP believes that stock prices generally reflect the market’s expectations of companies’ future earnings. Accordingly, outsized investment returns are available from identifying companies whose earnings can outperform the market’s expectations.

The team uses company visits and in depth discussions with company management, as well as industry research, to elicit insights that give them an edge over competitors.

Bennelong’s Portfolio and Recent returns

Fees

The fund has a 0.85% of assets under administration fee and a performance of 15% of any return that exceeds the ASX300 accumulation by 2%.

ASX Dividend Aristocrats Conclusion

The Bennelong Concentrated Australian share fund is a sound choice for investors looking for higher growth investment fund, provided they can accept the associated volatility. Mark East and his team have a long track record of exceeding their benchmark over the medium to long term (2 – 5 years plus) by investing in companies that are growing quickly and have a high likely hood of ‘surprising’ the market with their results. Many of their stocks are outside the ASX20 indicating. Investing in smaller stocks can lead to increased volatility as smaller companies generally have more volatile earnings. Overall the fund is a solid choice for investors looking to access a proven investment manager and a ‘growth’ style of investing, as long as they are comfortable with a slightly bumpy road of returns.

Leave a comment